TL;DR#

The rise of generative AI presents a unique challenge for pricing models. Unlike traditional ML, generative AI involves user interaction over multiple rounds of prompting and user satisfaction is binary. Existing pricing frameworks are insufficient for this new paradigm, failing to fully capture the dynamic between model performance, user cost, and competition within the AI market. This lack of a suitable framework creates difficulties for developers seeking to optimally price their products and navigate the market successfully.

This paper addresses this gap by developing a game-theoretic model of competitive pricing for generative AI software. The model considers two firms sequentially launching their models, analyzing the price-performance tradeoff for each firm, and evaluating user choice. The authors find that forgoing revenue on less-competitive tasks optimizes overall profit. Furthermore, the model demonstrates the importance of early-mover advantage, particularly the necessity of a minimum performance level to achieve profitability. Their findings provide valuable insights into the strategic aspects of developing and launching generative AI products.

Key Takeaways#

Why does it matter?#

This paper is crucial for researchers in AI economics and pricing strategies as it provides a novel framework for pricing generative AI models, considering user behavior and competition. It offers practical insights and new avenues for research on AI product development and market dynamics, potentially influencing future AI pricing models and market structures.

Visual Insights#

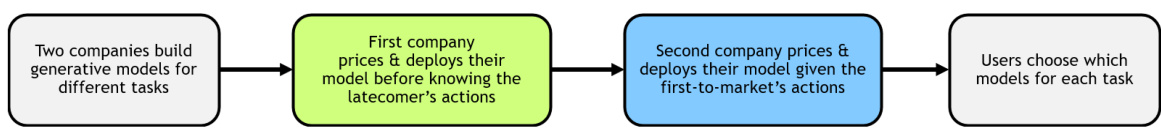

🔼 The figure illustrates a sequential game between two companies developing competing generative AI models. First, Company A prices and releases its model without knowing Company B’s actions. Then, after observing Company A’s model and price, Company B prices and deploys its model. Finally, users choose which model to use for each task based on price and performance. This depicts the competitive pricing dynamic in the generative AI market.

read the caption

Figure 1: Overview of the competitive pricing problem for generative AI models.

In-depth insights#

Generative AI Pricing#

Generative AI pricing presents a unique challenge, diverging significantly from traditional software or machine learning models. The per-prompt or per-token pricing model introduces complexities stemming from the variable number of interactions needed for user satisfaction and the model’s performance across diverse tasks. Competitive dynamics add another layer, requiring firms to strategically select tasks where they hold a price-performance advantage, potentially forgoing revenue on others. The first-mover advantage is nuanced; while early entry allows setting initial prices, it necessitates anticipating the latecomer’s response and market information plays a crucial role for late entrants. Model performance directly influences pricing decisions, creating a complex interplay between cost-effectiveness and revenue maximization. The analysis reveals that sufficiently similar tasks can negate the first-mover advantage, highlighting the necessity for first movers to possess a minimum performance threshold to remain competitive. Overall, successful generative AI pricing requires a deep understanding of user behavior, competitive landscapes, and the intricate relationship between model performance and pricing strategies.

Competitive Dynamics#

Analyzing competitive dynamics in the context of generative AI reveals key strategic considerations for firms. The sequential nature of model releases introduces a first-mover advantage, enabling early entrants to establish a foothold and influence subsequent pricing. However, this is countered by the ability of later entrants to leverage market information and potentially undercut pricing, highlighting the importance of strategic pricing and the continuous innovation required for market dominance. Price-performance ratios become critical in determining market share, emphasizing the need for a balance between cost-effectiveness and model quality. The piecewise nature of the pricing problem suggests that firms will focus on the tasks where their models are most competitive, thus, specializing in specific applications could be a strategy to increase profitability. Overall, the competitive landscape necessitates a deep understanding of user demand, model performance across diverse applications, and the strategic actions of competitors to achieve market success.

Multi-round Prompting#

Multi-round prompting in generative AI models addresses the limitations of single-turn interactions. It acknowledges that users often require multiple attempts to achieve satisfactory results, especially for complex tasks. This iterative process involves refining prompts based on previous model outputs, leading to a more conversational and collaborative user experience. The strategic use of multi-round prompting can significantly improve the overall user satisfaction and the quality of the model’s responses. However, it introduces challenges for evaluating model performance, as conventional metrics that focus on single-turn accuracy become less relevant. Researchers need to develop new evaluation methods that better capture the user’s overall experience, including the efficiency and effectiveness of the iterative prompting process. Furthermore, the cost-effectiveness of multi-round prompting needs careful consideration, balancing the potential improvements in output quality against the increased computational and time costs involved. Ultimately, optimizing the multi-round prompting strategy is crucial for enhancing the practicality and usability of generative AI models.

Market Info Value#

The concept of ‘Market Info Value’ in the context of generative AI pricing strategies is crucial. It highlights the competitive advantage gained by a company entering the market later, armed with knowledge of its competitor’s pricing and market response. This contrasts sharply with the first-mover disadvantage, where pricing decisions must be made without complete market information. A later entrant can strategically select tasks where they possess a competitive advantage and thereby achieve cost-effectiveness, potentially maximizing revenue by focusing on a profitable niche instead of attempting to compete across the entire spectrum of tasks. The ability to leverage market information reveals that the timing of market entry is a vital strategic variable. This advantage, however, is nuanced. The value of market information is directly linked to the degree of similarity between the different tasks being offered by the competing AI models. If tasks are sufficiently similar, the first-mover’s strategy becomes risky and could potentially result in complete cost-ineffectiveness regardless of pricing. Consequently, market information provides a significant strategic advantage but only within specific market conditions.

Model Performance#

Model performance is a crucial aspect of any machine learning system, and its evaluation requires a multifaceted approach. Metrics for assessing performance vary widely depending on the specific task and the nature of the model itself. For example, classification models might use accuracy, precision, recall, and F1-score, while regression models might use mean squared error or R-squared. Beyond standard metrics, evaluating the robustness of a model to variations in input data, its generalizability to unseen data, and its computational efficiency is also critical. A high-performing model on a specific dataset may not necessarily generalize well, which is a major concern. Furthermore, ethical considerations are paramount, as a model’s performance could have unintended and negative societal consequences if not carefully examined. Analyzing and interpreting the different aspects of model performance is essential to developing reliable and responsible machine learning systems.

More visual insights#

More on figures

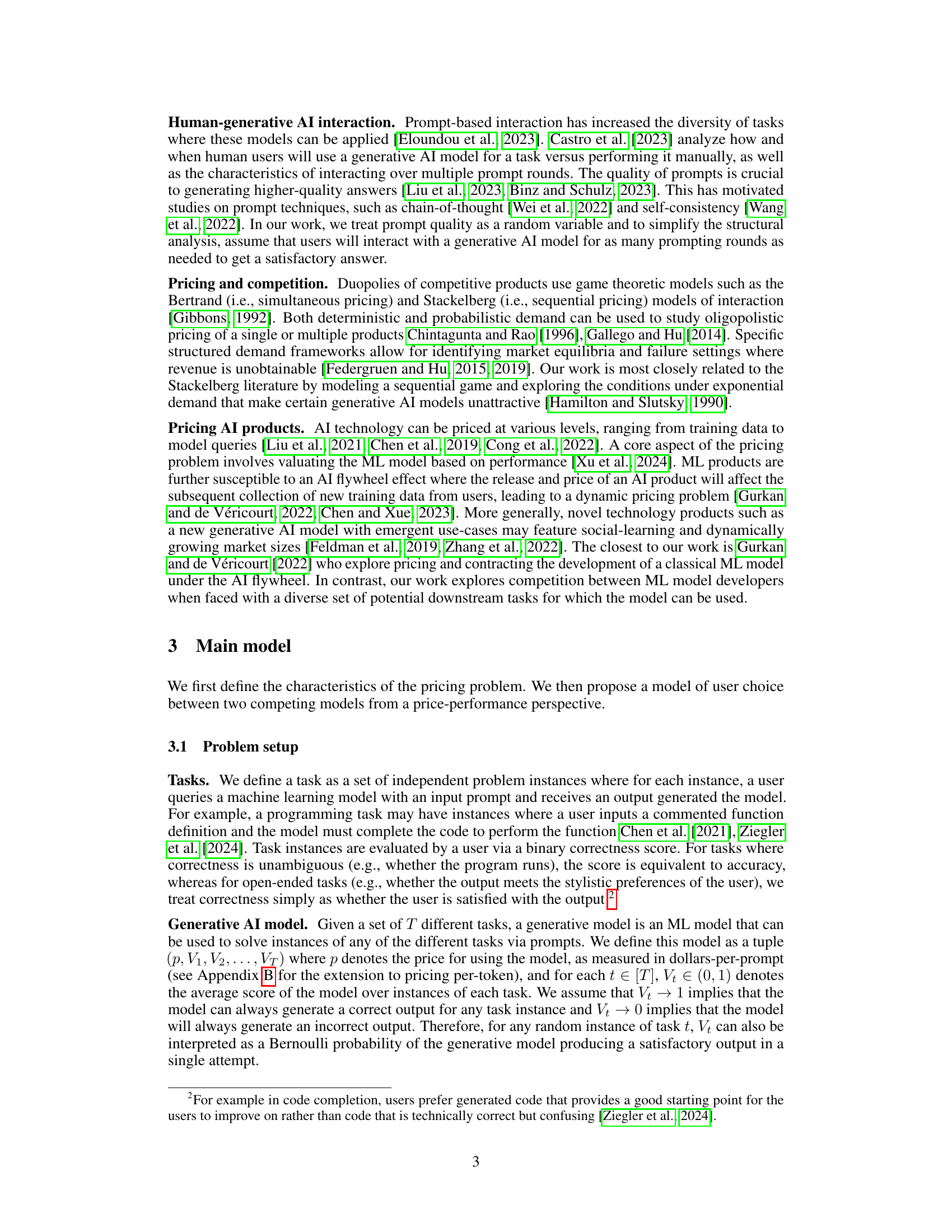

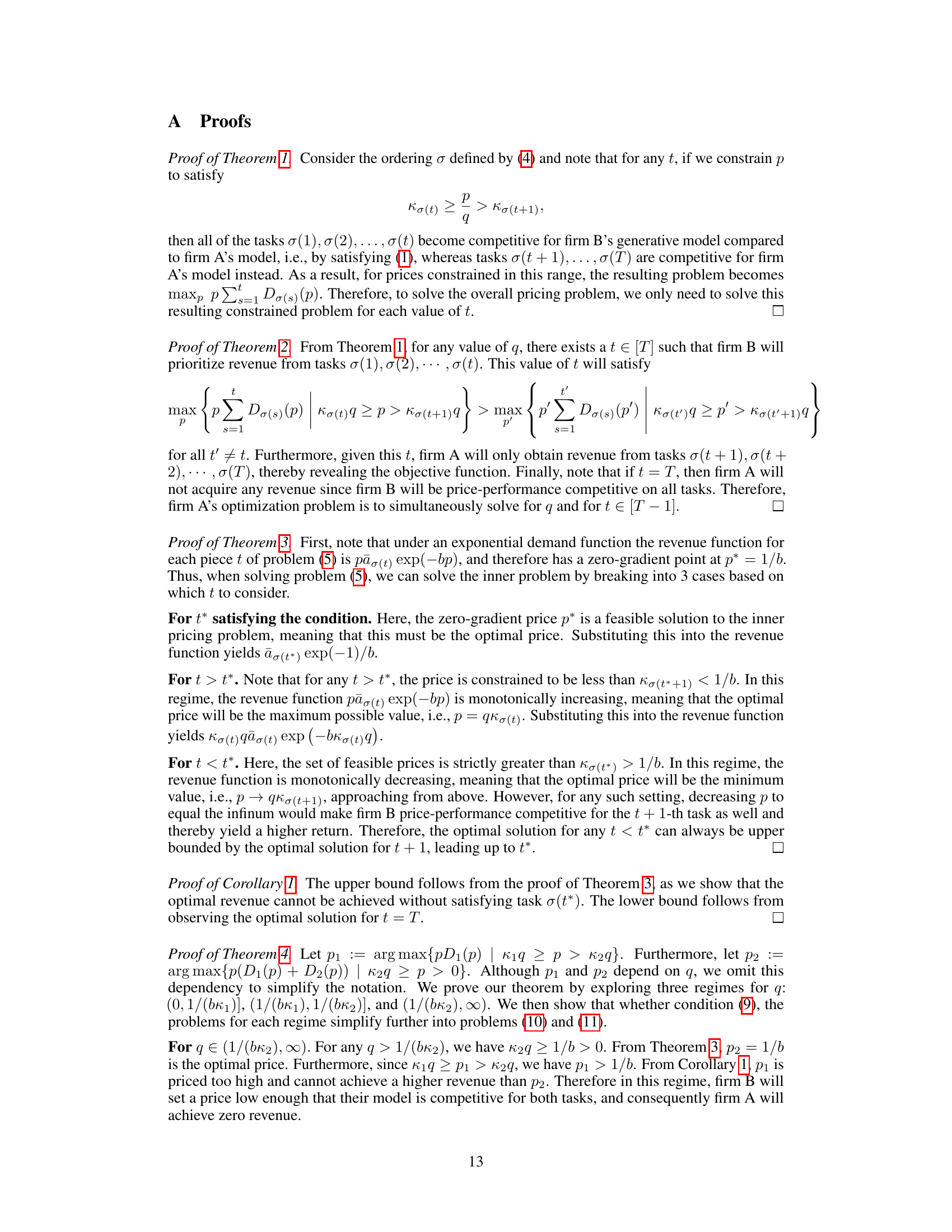

🔼 This figure shows the demand and revenue functions for three different tasks with exponentially decaying demand. The left panel displays the demand for each task as a function of price. The right panel shows the revenue generated by each task and the total revenue as a function of price. The vertical lines in the right panel represent thresholds in pricing where the model becomes non-competitive for certain tasks, leading to a piecewise revenue function.

read the caption

Figure 2: (Left) Three tasks with three different exponential demand functions D₁(p) = 100e-0.5p, D2(p) = 200e-0.5p, D3(p) = 400e-0.5p. (Right) The corresponding revenue from each task along with the total revenue function for a firm RB(p). The vertical lines correspond to k₁q, k2q, and K3q, where K1 > K2 > кз. For p < k3q, revenue is obtained from all three tasks, for p ∈ (K3q, K2q], revenue is obtained from only the first two tasks, and for p ∈ (K2q, K1q], revenue is only obtained from the first task. No revenue can be obtained if p > K1q.

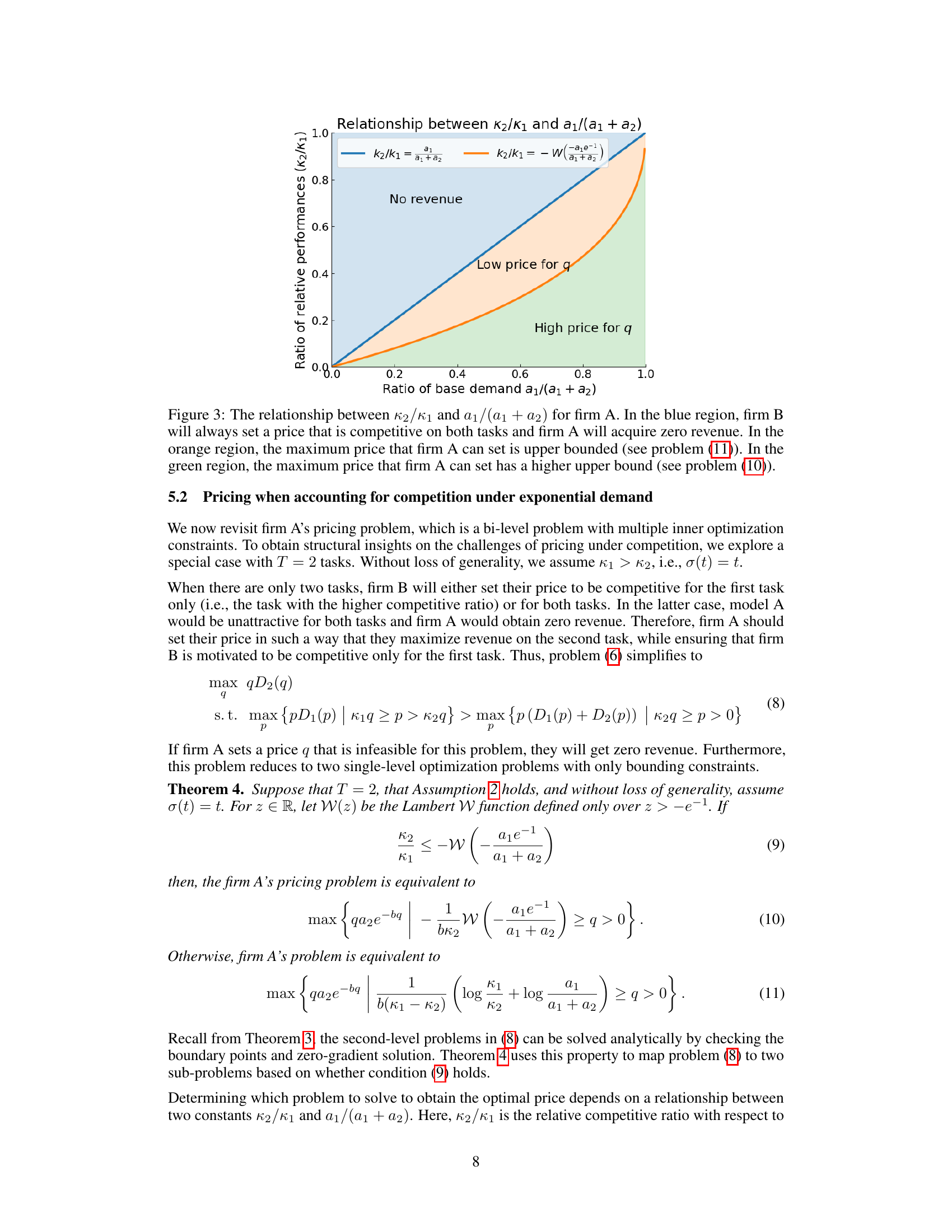

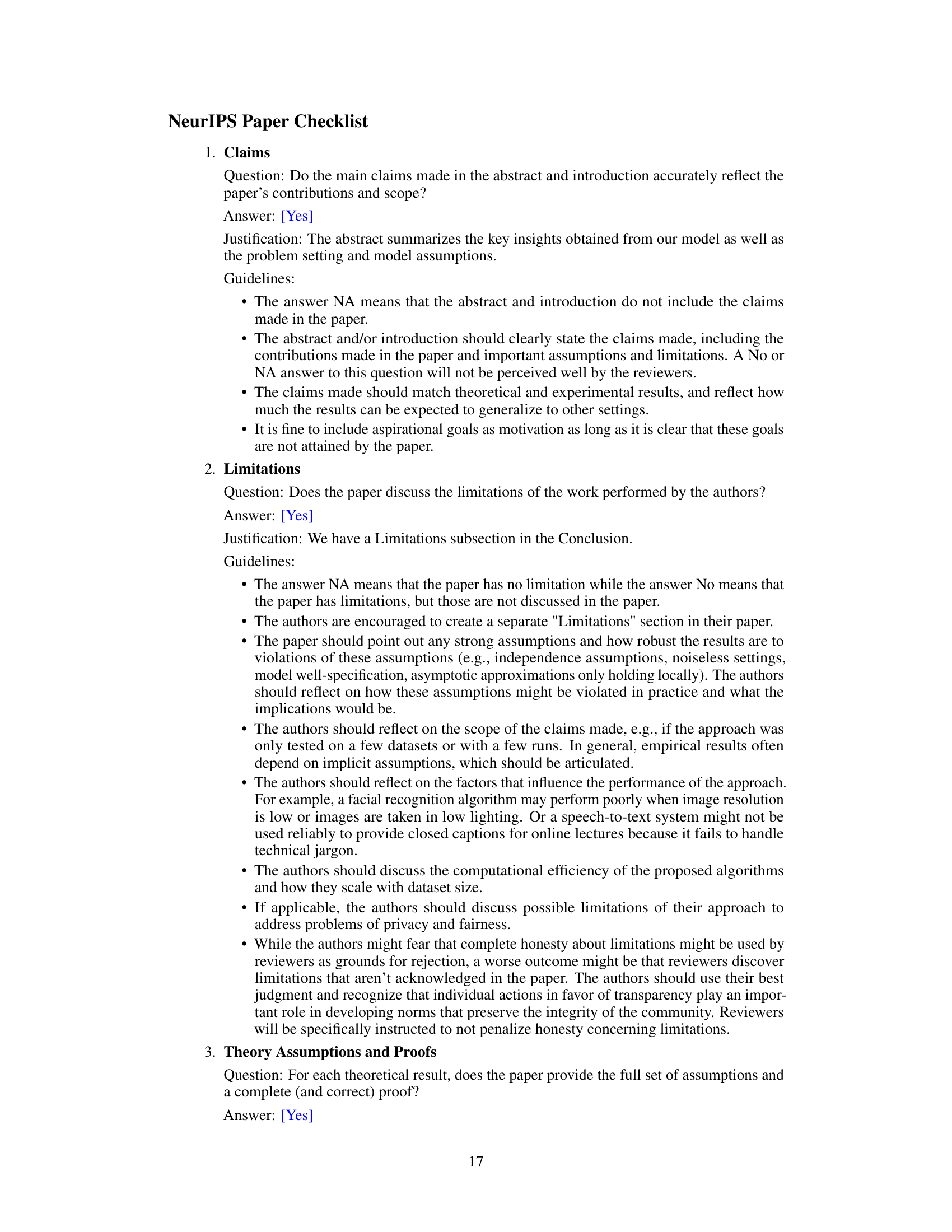

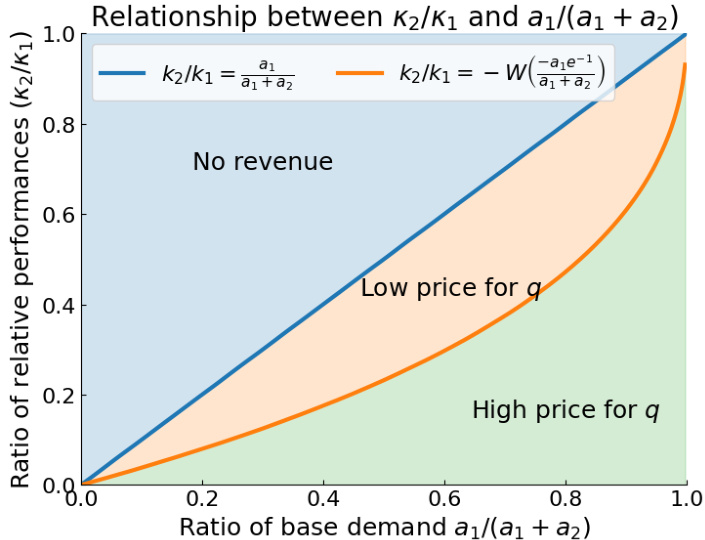

🔼 This figure shows the relationship between the ratio of relative performance (κ2/κ₁) and the ratio of base demand (a₁/(a₁ + a₂)) for firm A in a duopoly game. The x-axis represents the ratio of base demand, while the y-axis represents the ratio of relative performance. The graph is divided into three regions based on the optimal pricing strategies for firm A and firm B. In the blue region, firm B will always set a price that is competitive for both tasks, resulting in zero revenue for firm A. In the orange region, the maximum price firm A can set is limited by the model’s performance and demand ratio. Finally, in the green region, there is a higher upper bound for the maximum price firm A can set.

read the caption

Figure 3: The relationship between κ2/κ₁ and a1/(a1 + a2) for firm A. In the blue region, firm B will always set a price that is competitive on both tasks and firm A will acquire zero revenue. In the orange region, the maximum price that firm A can set is upper bounded (see problem (11)). In the green region, the maximum price that firm A can set has a higher upper bound (see problem (10)).

Full paper#