↗ OpenReview ↗ NeurIPS Homepage ↗ Chat

TL;DR#

Current online advertising markets increasingly use autobidding, where advertisers aim to maximize their value subject to a return-on-spend constraint. Prior research indicated potential for welfare losses with non-uniform bidding, but lacked fine-grained analysis. This paper addresses this gap. The study analyzes the price of anarchy in first-price auctions with value-maximizing autobidders capable of non-uniform bidding. They introduce a novel parametrization capturing the power and balance of autobidders’ bidding strategies.

This paper presents a fine-grained analysis of the price of anarchy in first-price auctions with non-uniform autobidders, showing how more powerful (non-uniform) bidding strategies lead to worse aggregate performance in terms of social welfare. The results match recent empirical findings, proving theoretically that less powerful autobidders result in better efficiency, and showing that efficiency further improves with more balanced auction slices. This offers crucial guidance for designing more efficient marketplaces.

Key Takeaways#

Why does it matter?#

This paper is crucial for researchers in auction theory and online advertising. It provides a theoretical framework for understanding the counter-intuitive impact of sophisticated autobidding strategies on auction efficiency, challenging existing assumptions and offering valuable insights for marketplace design. The findings can inform the development of more efficient auction mechanisms and better strategies for advertisers.

Visual Insights#

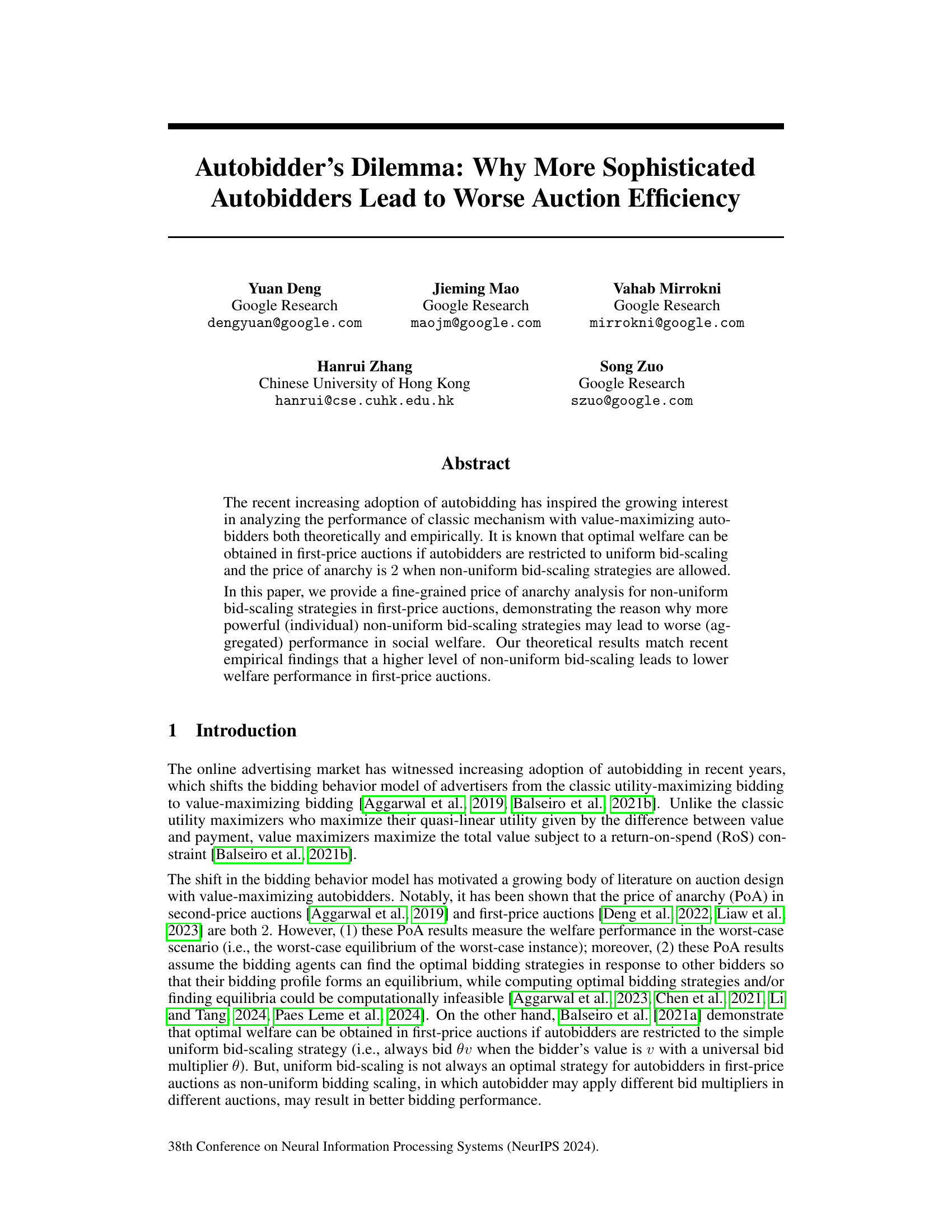

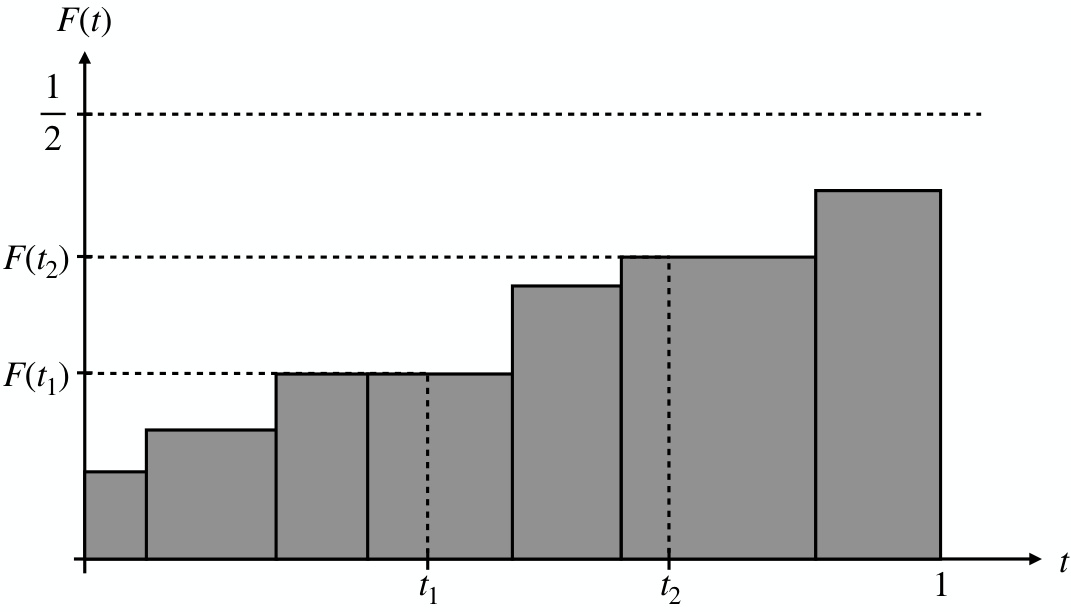

This figure provides a graphical illustration of the balancedness quantile function, a key concept in the paper. The x-axis represents the cumulative market share, and the y-axis represents the balancedness of each slice. Each rectangle represents a slice (k) in the market. The width of the rectangle corresponds to the market share of that slice (sharek), and the height corresponds to its balancedness (balk). The figure visually demonstrates how the balancedness quantile function aggregates the balancedness across different slices to characterize the overall efficiency of the market.

Full paper#