↗ OpenReview ↗ NeurIPS Homepage ↗ Chat

TL;DR#

Online bilateral trade platforms typically aim to maximize the total gain from trade, often neglecting fairness among buyers and sellers. This paper addresses this gap by introducing the concept of fair gain from trade, which prioritizes equal utility distribution. Existing algorithms that optimize for the sum of utilities can perform poorly when fairness is considered. This raises a significant challenge in developing online platforms that are both efficient and fair.

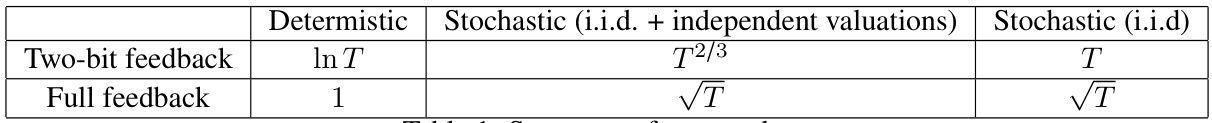

The authors propose a new algorithm based on fair gain from trade and carefully analyze its performance. They derive tight regret bounds in several settings, including deterministic and stochastic valuations for sellers and buyers, with and without the assumption of independent valuations. Their findings demonstrate that achieving fairness introduces new challenges in online learning, even when sellers’ and buyers’ valuations are independent, highlighting the inherent trade-off between fairness and efficiency.

Key Takeaways#

Why does it matter?#

This paper is crucial for researchers in online learning and mechanism design, particularly those focusing on fairness and bilateral trading. It provides a novel theoretical framework for online bilateral trade that incorporates fairness, which is a growing concern in the field. The results will help guide the development of more equitable and efficient online marketplaces, impacting areas like ride-sharing and online advertising. The regret bounds are highly relevant to theoretical computer science, and the algorithms presented open up possibilities for novel algorithm designs and analyses.

Visual Insights#

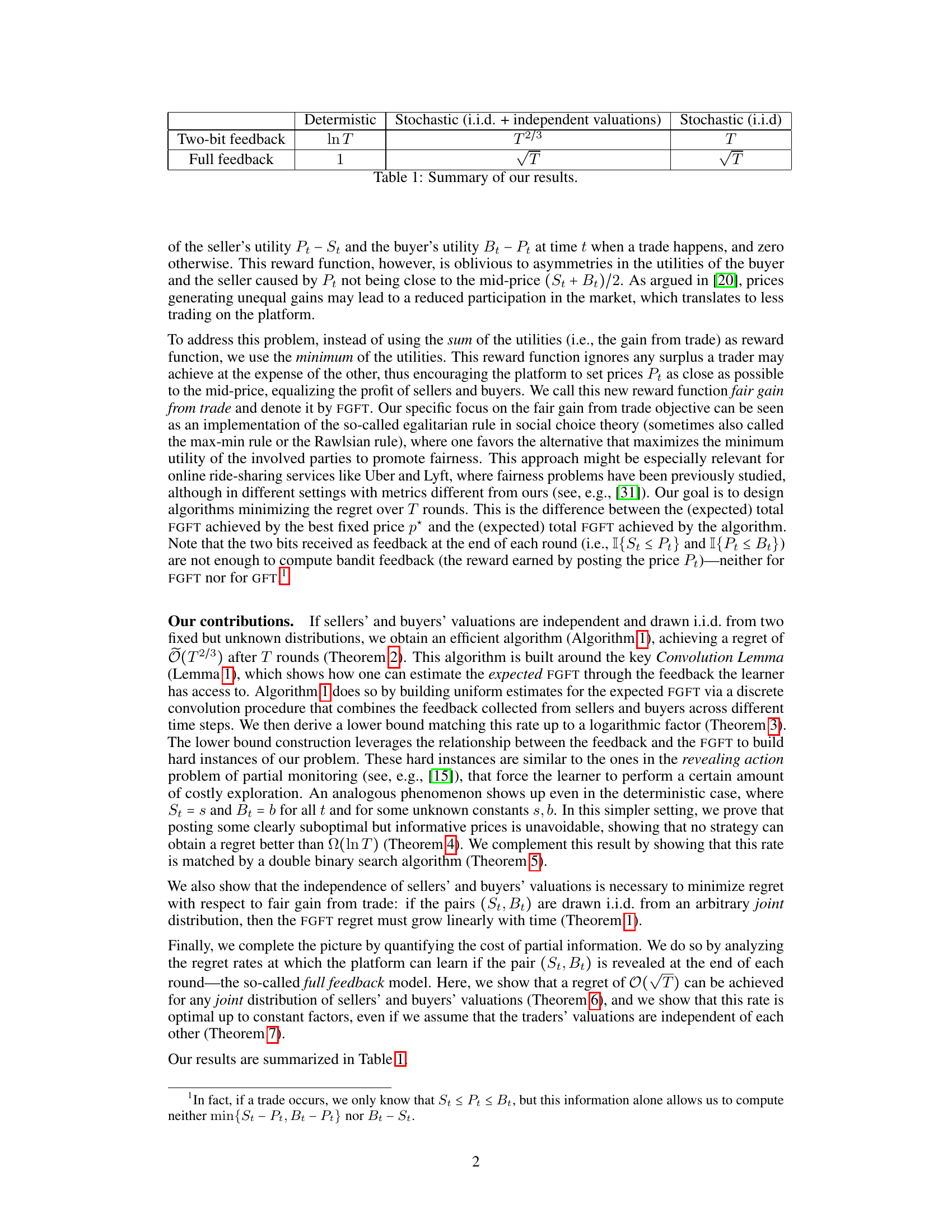

This table summarizes the regret bounds achieved by the proposed algorithms under different settings. It shows the regret (difference between the expected total fair gain from trade achieved by the best fixed price and that achieved by the algorithm) in terms of the number of rounds (T). The settings vary across deterministic and stochastic (independent and identically distributed (i.i.d.)) scenarios for seller and buyer valuations, and the amount of feedback received by the platform (two-bit or full feedback).

Full paper#